In the past, Wall Street and finance used to be an all-white “good ole boys club” akin to Mad Men. This has changed in recent years and great progress has been made. Despite this progress, we still have a lot more work to do to achieve in terms of parity. According to a recent report, less than 17 percent of senior positions in investment banks are held by women.

Authority Magazine recently ran a series called “Meet The Female Leaders Of Finance.” In the series we asked dozens of prominent women leaders in finance about the improvements in gender bias, so far, and what can be done to sustain this progress. Here are 10 highlights from the series.

These interviews have been edited for length and clarity.

Kirstin Hill (Strategic Performance Executive at Bank of America Merrill Lynch)

Why there has been more improvement in the area in recent years:

In my view, many things have triggered it. First, there’s the simple fact that representation matters. Diverse representation at all levels is imperative to long-term business success, whether it’s women, people of color or members of the LGBT community. As the gender and complexion of wealth changes, leadership needs to reflect these changes.

Financial firms are recognizing the positive impact diversity has on their companies’ performance. Firms are smarter and more effective when they include a group of diverse people. It brings in more perspectives and ideas, allowing organizations to think more creatively. Meanwhile, the absence of diversity has adverse consequences. It impedes the ability to hire, develop, grow and serve the next generation.

For us, it started as a commitment from our leadership team: Our CEO Brian Moynihan and Merrill Lynch Wealth Management Head Andy Sieg. Andy specifically emphasizes how delivering across our clients’ financial lives means delivering through diversity. From the top of our organization to the hyper-local level, diversity is a non-negotiable top priority. Diversity has become pervasive in terms of how we think about what we do every day. It’s both a moral and business imperative.

Steps that can be taken by individuals, companies and society to support this change going forward:

We see it as our duty to continue the momentum toward women’s empowerment, and we all have a role to play. A key first step is ensuring women and diverse populations build the education and confidence. They need to reach their financial goals. As women grow more comfortable with their finances, they are more likely to continue exploring the finance industry and all it has to offer in the future either as members of the workforce or clients. Deeper education leads to greater representation, which results in more companies committed to women’s financial needs and advancement. These great companies then pave the way a more equitable, forward-thinking society. Here are a few steps to support this change:

- Learn from the generations around you. Have conversations with family and friends that destigmatize difficult money conversations. There is so much to be learned from the shared experiences that our peers, friends and family have gone through, like sending a child to college or beginning to invest.

- Take advantage of any employer-sponsored financial education programs. Take advantage of employer-sponsored workshops and benefits available to make the most of your financial future and navigate complex paths. According to a recent Merrill Lynch report on employee and employer financial wellness, nearly all employees who take advantage of workplace financial wellness programs say these resources have been effective. In turn, employers should offer holistic benefits that meet the needs of a diverse workforce, including personalized benefits, mentorship programs and networks, so they can set a standard they can be proud of for employee benefits offerings.

- Continue the conversations about financial equality. Of 1,594 pages of editorial content in the March 2018 issues of the top 17 women’s magazines, there were only five pages covering personal finance topics according to a recent Merrill Lynch study; that is less than 1 percent. This issue is even more stark when analyzing personal finance materials targeted specifically toward minority groups such as African American, LGBT+ and Hispanic/Latina women. The more accessible we make conversations about personal finance in society, the more diverse, capable and confident our collective financial future looks. Action results in change, and if action is taken to educate individuals, companies, and society, these steps can help propel us into a better, more equal future.

Tifphani White-King (US National Tax Practice Leader at Mazars USA)

Why there has been more improvement in this area in recent years:

Yes, I do see there has been change, but not enough. There is still significant gender imbalance with respect to senior levels of power, as well as compensation in the world of finance and beyond.

Steps that can be taken by individuals, companies and society to support this change going forward:

To correct gender imbalance, companies have to have an honest assessment of their culture, hiring and promoting practices. Some questions that need to answered include:

- Look at the number of new hires that interview at or enter your organization. How many of your candidates are women?

- Once hired, do women feel included in the culture of your company? Are they provided with the same mentorship and/or sponsorship opportunities afforded to men? Are they invited to meetings and social outings? Are they invited to compete on competitive bids and to work on highly visible, revenue-generating projects? Do they feel supported in work and life?

- Do women at your company support, share and promote the success of other women?

Susannah Stroud Wright (Chief Legal Officer at Credit Karma)

Why there has been more improvement in this area in recent years:

I think the advent of technology has helped diminish traditional, narrow practices and ways of thinking that have for a long time plagued innovation in the finance industry. As financial services organizations grapple with new technology, regulations, and consumer expectations, hiring practices must account for a broader range of skills as a result of a more diverse pool of talent. There is substantial evidence that shows that diversity enhances company performance and that new ways of thinking are required to spur innovation, especially in the financial services sector, which arguably, has not innovated at the rate of other industries.

Credit Karma’s member base is highly diverse, which I am sure is true for many financial institutions, and a company needs diverse internal viewpoints to best serve their consumers. Financial institutions are realizing that if they want to reach as many people as possible, they must understand a wide variety of consumers and what sets their company apart from others.

Steps that can be taken by individuals, companies and society to support this change going forward:

- Executive accountability. Companies that have a limited number of female leadership roles can hinder internal female employee motivation. Having more females at senior-level executive roles will inspire a “get to the top” attitude and drive for entry- and mid-level female employees.

- Set clear goals. Adopting company-wide diversity goal metrics will help turn talk into action. Implementing a regular cadence of reporting on the gender and racial makeup of your company solidifies diversity as a business priority.

- Hiring. Provide educational courses and trainings on things such as unconscious bias to equip employees with best practices that prevent them from having a discriminatory effect on hiring or promotional decisions. Also, adopt diverse interview panels to help keep bias out of the hiring process

- Flexibility. Create programs that help both men and women balance their home and work responsibilities.

- Mentoring and sponsorship. Ensure that both men and women are mentoring and sponsoring women throughout their careers. I’ve been extremely fortunate to have had some fantastic sponsors, some of whom are men and some of whom are women. The more men who focus on sponsoring women, the more rapidly we’ll see progress.

Ginger Siegel (North America Small Business Lead at Mastercard)

Why there has been more improvement in this area in recent years:

I truly believe that when Wall Street and the world of finance opened their eyes to the amazing knowledge, empathy, creativity, and desire to change the world of women, they realized they had to utilize this tremendous source within the modern workforce.

Steps that can be taken by individuals, companies and society to support this change going forward:

As someone who has hired many people in their career, I know how important it is to hire the best person for the role. But we must always over-index on to ensure that there is a very diverse slate of candidates, overreach to talk to people that we may not normally consider and focus on both hard and soft skills.

In one of my roles leading small business for a large financial institution, I was hired to start a small business organization from scratch and had less than a year to hire 500 small business bankers. In case you were already doing the math in your head, yes, that is about 45 per month. We brought in 30 recruiters and hit that number in the allotted time frame. What the process taught me is that maniacal focus is critical to achieve anything worth achieving. Focus breeds success,

Jane Greenfield (President at Vanguard Charitable)

Why there has been more improvement in this area in recent years:

This change is due to the race for talent and the recognition that talent is not limited to one group. If you want the best and the brightest, cutting out 50 percent of the workforce makes no sense; women need to be included. The same goes for people of different racial backgrounds. The world has become more and more competitive, and organizations need top talent to figure out how to meet the evolving needs of their clients by staying one step ahead. To make matters more complex, the talent we are seeking is more mobile. Today, organizations are competing on a global front for talent, not just locally or nationally. Managers need to focus on getting the best talent available and recognizing that talent does not always look like them.

I am thrilled to see greater diversity represented now than in the past, and not just because I’m a woman. Greater diversity in finance means there is greater acceptance and appetite for diverse thought. Moreover, diverse thought derived from teams of different backgrounds and perspectives can breed better results.

Steps that can be taken by individuals, companies and society to support this change going forward:

It’s a great question, particularly as it takes all three (individuals, companies, and society) for us to make additional progress.

- For women: Know what you want, and go after it. Do so with passion, curiosity, and intent. If you hit obstacles or have a moment where you doubt your ability to succeed, reach out to mentors and friends who you trust and ask for their help. Don’t do it alone; build your base of support and ask them to help you as you drive to meet your goals.

- For men: Proactively help women succeed. There are a lot of talented women who need your help, either because they don’t recognize they are ready for the next challenge, or they are challenged in managing their responsibilities at work and beyond. Engage them, and be an advocate who pushes them further than they are pushing themselves. Ask them what they need, and be ready to jump in and help. They will ask for help in a different way (perhaps in a less direct way) than your male colleagues. Don’t miss the signs.

- For companies: Engage female colleagues and find out what they need from the company in order to progress. Organizations that not only listen to their female talent but also flex to meet their needs, will retain top women and create an environment that attracts more. Organizations that are relentless in thinking through how to propel women forward and understand the power of having both women and men at senior levels will figure it out. These are the companies that will consistently command talent. I would put my bet on those companies any day of the week.

- For society: Celebrate the woman who achieves success in business, and don’t assume her family is less important to her. Help her, and thank her for paving the way for you, your daughters and your sisters. When my kids were young, I had the great fortune of having an incredibly supportive family and group of friends. One friend I like to highlight was a stay-at-home-mom whose daughter was in my daughter’s class at school. On snow days, she would call me and offer to take both my daughter and son for the day. As it turned out, I never ended up having to take her up on her offer, but the easing of stress from her consistent support was priceless. She is an example of a strong woman helping other women, and I am truly grateful for her friendship.

Alpa Lally (VP at Experian)

Why there has been more improvement in this area in recent years:

I think awareness, education, and support from male leaders has helped create this shift. There’s still work to do, but the more companies embrace diversity like Experian has, I think we can continue to create meaningful impact and ultimately more successful and inclusive companies.

As I mentioned, Experian promotes a diverse and inclusive community. We embrace and celebrate the diversity of ideas and backgrounds across the company. This diversity of thinking, and the way we harness it at Experian, helps to fuel our innovation and ultimately our ongoing success as a business, including our policies around flexible working hours, paid parental leave and clubs within our company.

Our “Women in Experian Employee Resource Group” is focused on championing and cultivating women leaders. Groups like this make a big difference in empowering and elevating women. We also invite male colleagues to join the group and collaborate, as we know it’s vital that men are also active participants in advocating for women.

Steps that can be taken by individuals, companies and society to support this change going forward:

In order to support an increase in female leadership, I think individuals can get involved in resource groups, seek out guidance from leaders and ask a lot of questions. It’s important to get smart about your industry so that you can continually provide an educated point of view. I’d also encourage individuals to find a mentor in a leadership position. Mentorship can be extremely valuable for career advice and decision-making. Lastly, as an individual, it’s important to believe in yourself. Push yourself out of your comfort zone and you may be surprised about what you’re capable of.

I believe companies can help their employees and promote leadership development by making resources available. We offer our education assistance program at Experian which gives partial tuition reimbursement that employees can use if they’d like to go back to school while still working at Experian.

Lastly, as a society, I think we can do a better job of empowering younger generations to set and go after their career goals, regardless of gender.

Jennifer M. Flynn (Head of Small Business Bank at Capital One)

Why there has been more improvement in this area in recent years:

I think people caught on to the fact that the world doesn’t look like only one gender or one race. Today, four out of every 10 businesses in the US are now owned by women, which is a remarkable growth trend. Even better, the changing demographics of small businesses doesn’t just touch women. New data compiled by The Business Journals show there are more than 11 million minority-owned businesses in operation nationwide, nearly double the number 10 years ago. As the business world becomes more diverse and more leaders learn to speak up and share their ideas, people are uncovering some unique and exciting truths. Namely, diversity breeds success.

Steps that can be taken by individuals, companies and society to support this change going forward:

There are many reasons this is still the case and we all (female executives, companies and society) have the ability to elevate women further and enable more seats at the executive table in finance.

As women continue to rise to leadership positions in the business world, women should focus on:

- Lean into discussions involving the financial health of their business. Understanding the finance of a business is integral to success.

- Build relationships. Relationship-building comes naturally to many women. This “superpower” can pay dividends in the business world.

- Be aware of knowledge gaps. To fill them, women should look to surround themselves with experts and resources. Also, it’s important to be unafraid to ask questions.

Companies should also focus on:

- Create and foster an inclusive and flexible work environment that attracts and retains talent. In other words, invest in leaders who “walk the talk.”

- Harness the power of technology to promote flexibility. With a computer, an iPhone and a strong work ethic, many jobs can be done from anywhere these days.

- Adopt best practices. A good place to start would be for companies to look into their benefits packages and ensure they accommodate the needs of women today. Capital One has earned spots on Best Companies for working women, executive women and for multicultural women and offers generous maternity leave packages, emergency childcare services, and financial help for those using surrogates, fostering or adopting a child.

Society should focus on:

- Pay it forward. Women can model the behaviors they want to see adopted by businesses and leaders.

- Embrace varying perspectives. See differences as opportunities to grow.

- Push forward. Continue to push for gender equity and equal rights.

Katie Miller (SVP at Navy Federal Credit Union)

Why there has been more improvement in this area in recent years:

From my perspective these days, everyone seems to be working. Unemployment is the lowest I’ve seen in my lifetime, and the United States looks different demographically, so doesn’t it make sense that companies, and the leadership in these companies, would look different as well?

Steps that can be taken by individuals, companies and society to support this change going forward:

- People should make an effort to establish relationships with mentors early on in their career. No one is going to hand them a leadership role; they have to take charge of their professional development and then, once they’re in management, work to develop their leadership skills.

- Companies need to make a conscious effort to do the right thing, which includes hiring and promoting a diverse array of people. When a leadership team consciously creates a culture of inclusiveness, employees of all levels benefit.

- I would love to see more visible and reasonably priced opportunities for working parents to get help taking care of kids. Finding and paying for daycare is not easy.

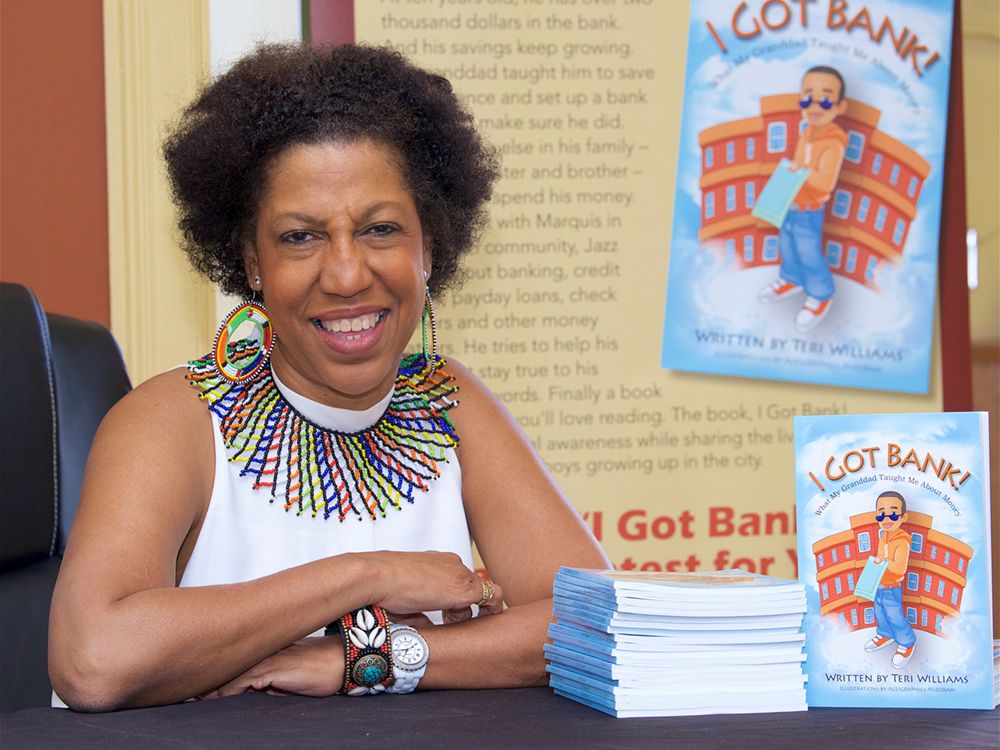

Teri Williams (President of OneUnited Bank)

Why there has been more improvement in this area in recent years:

It’s still mainly a white boys club! However, technology has democratized information and transactions to the point where relationships, particularly those without merit, are less valuable. Now, we must compete against a global market with our ideas. There continues to be insufficient capital for women and minorities with great ideas, but the playing field has become more level.

Steps that can be taken by individuals, companies, and society to support this change going forward:

Everyone knows what needs to be done. There’s simply a lack of will, from my perspective. Here are some things that need more attention:

- Recognize the financial service industry is deeply biased and needs to atone for its historical discriminatory practices.

- Allow women the same latitude to fail as their male counterparts, because without risk, there’s no reward and there’s no risk without failure! I believe a key ingredient for success is to recognize quickly when something is not working and to adjust. The not working part, or failures, provide the best lessons.

- Invest capital in companies with diverse leadership because it’s been proven they perform better. Financial literacy should be taught in elementary school and it should be made to be more fun! I wrote a children’s book, I Got Bank, What My Granddad Taught Me About Money for this very reason. It’s a book to educate youth about almost everything they need to know about money. It’s fun, easy to read, culturally relevant and educational. We hold a financial literacy essay and art contest every year, and thousands of children from all over the country submit the most amazing work! Ten children, who submitted the winning entries, received $1,000 for the best entries. Money can be fun and not boring.

Heather Brilliant (CEO at Diamond Hill Capital Management)

Why there has been more improvement in this area in recent years:

There has been a lot of research over the past decade or so showing the importance of cognitive diversity in improving outcomes of how groups make complex decisions. I think that helped change a lot of minds, and helped people realize diversity is a business imperative, not just a nice feature to have.

Steps that can be taken by individuals, companies, and society to support this change going forward:

I agree there is still a lot to be done to improve diversity. There are so many things firms can do to move in the right direction, but I have found three of the most impactful to be:

- Improving the pipeline. Improving the pipeline relates to encouraging more women, people of color, and people of varied backgrounds to consider careers in financial services.

- Requiring diverse candidate pools. Every company needs to itself, the recruiting industry and HR departments to put forward a diverse pool of candidates for any potential role.

- Promoting a culture of inclusive leadership. Inclusive leadership is about helping our teams understand that we all hold biases, and we need to create teams that encourage different ways of thinking so that when we do add diversity to teams, the team can be successful in embracing those diverse points of view.